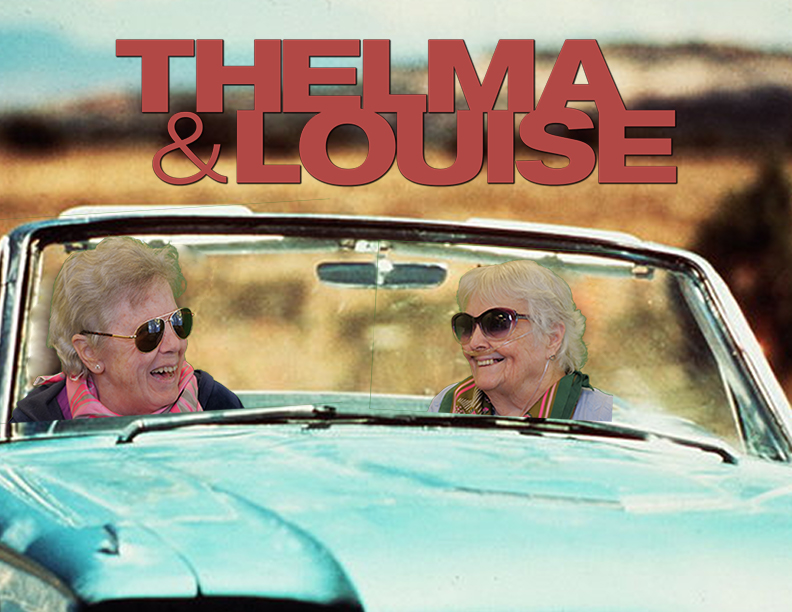

I thought the very best way to talk about an uncomfortable topic was to fill this post with the amazing movie photoshoot we had for my senior living. I selected the movies, dressed up my residents, and we staged them on a green screen.

Enjoy reliving these old movie posters while reading about preparing for your aging parent.

Are You Worrying about Your Aging Parent?

Do you find yourself worrying about your aging parents? Maybe you’re concerned about whether they’re adequately prepared for their later years. Or maybe you don’t know what their final wishes are.

Many parents have to deal with tricky conversations with their children. However, you don’t necessarily expect it to be the other way around. It just doesn’t seem right, does it? I mean they are our parents! That said, I’m a firm believer in having these conversations while everyone is of sound mind and ahead of any unexpected events. Read on for important questions to ask aging parents. I’ll also give you some tips on how you can tactfully approach these difficult topics.

Have the Uncomfortable Conversation Now

Do you want a “must have” checklist to prepare for senior living? Enter your email below to download immediately.

Signup for this “must have” checklist

Thank you!

You have successfully joined our subscriber list.

Talk About Money

Some important things for you to find out from your parents

Their current income and expenses

All bank accounts and credit card details including online passwords

Insurance policies (life, home, auto, medical and disability)

Mortgages, titles, and deeds

Pensions. How much monthly?

Contact details for professionals dealing with any of the above (maybe even attend meetings together?)

Will – where it is and who the executor is. Confirm it’s up to date.

Beneficiary Designations – are they up to date? They need to be as they trump the Will.

What is their overall Estate Plan? Do they have a Trust?

Where are all the financial documents kept?

Check out my post Untapped Veteran Financial Assistance to find out if your parents are eligible for this financial benefit.

Talk About Their Health

We all hope our parents live a long and healthy life. However, the reality is many will eventually become too ill or frail to look after themselves. For this reason, it’s important to look at their current and long-term health plans. It’s essential to ensure they have everything they need to be well looked after.

Here are a few things that you’ll need to find out now:

Current doctors – are they happy with them?

Current medications – any side effects or allergies? Are they able to take them on their own? Which pharmacy do they use?

Health insurance – are they adequately covered? Medicare starts at 65 but they probably need to invest in a supplemental cover.

Do they have an Advance Medical Directive? This will state their requirements with regard to life-support measures. Do they want to be kept alive with ventilators and feeding tubes?

Medical documents – where are they kept?

Check out my popular post, Paying for Senior Living. What you Need to Know.

Talk About Their Home

Most people will want to stay in their own house for as long as possible. However, there will come a time when they’ll need to make changes or even move. You may find your parents become very frail or even disabled, and their movement becomes restricted. This is a good time to make some changes to their home to ensure they are comfortable and safe.

This could simply involve adding handrails and night-lights. Installing a stairlift may be a safer option than worrying about them walking up and downstairs. But these modifications can be expensive. How about moving their bedroom to the first floor, if it isn’t already? I’m sure they’ll be relieved at not having to keep climbing all those stairs!

Discuss the Difficult Decisions

Do they want to be resuscitated if the situation arises? Do they have a DNRO?

Do they want to be cremated or buried? Where?

What kind of funeral/memorial do they want?

If you need to apply for financial assistance, you need to start gathering this documentation

Social Security Card.

Driver’s license or another photo identification.

Birth certificate, proof of citizenship, or voter registration card.

Current Will, Health Care Surrogate Designation, Living Will, Trust, Power of Attorney, and Premarital Agreement.

Medicare Card and written proof of monthly premiums.

Long term care insurance policy and written proof of monthly premiums.

Supplemental health insurance policy, insurance card, and written proof of monthly payment.

All life insurance policies.

Statement from the insurance company for life insurance policies showing face value, death value, and cash surrender value.

Copies of all property deeds, vehicle titles, mobile home titles, most recent tax bills, insurance premium statements for all real estate, homes and/or personal property.

Car title, vehicle registration, and insurance policy with premium statements for each vehicle.

Copies of the last 12 statements for all bank accounts, brokerage/investment accounts, stock certificates, bonds, IRA’s, retirement accounts, and copies of all certificates of deposits, mortgages, promissory notes or any other asset.

Copies of all annuity policies and statements of the last three payments.

Documents of all GROSS current monthly income including social security benefits.

Date social security benefits began if known. If you need help, go here.

Copies of all funeral, burial, and cremation contracts, cemetery lots and/or burial plots, whether prepaid or not.

The last three statements from every asset owned by the husband or wife closed within the last three years and documentation showing where the asset went.

All written documentation stating the GROSS current amount of all pensions and deductions. If no documentation, call the company or administrator to request information to be sent to your home immediately.

All rental agreements and maintenance/condominium fee agreements.

Mortgage papers unless the mortgage has been satisfied (mortgage note and amortization schedule).

Documentation (bank statements, canceled checks, deeds, written statements tc.) showing all gifts made within the last three years. Must have the EXACT date of the gift amount.

“Sale” information for all assets sold or transferred in the last three years, including the amount of proceeds from the sale and where funds went.

Closing documentation for all certificates of deposit, insurance policies, stock certificates, annuities, and other accounts or assets closed within the last three years.

This can seem overwhelming, that’s why it’s important to start today. Begin by asking questions and later gather documentation. Comment below if you have any questions.

Do you want a “must have” checklist to prepare for senior living? Enter your email below to download immediately.

Signup for this “must have” checklist

Thank you!

You have successfully joined our subscriber list.

XOXO

Mackenzie